Southeast Asia: The Next Frontier in Venture

August 2025

Southeast Asia’s (SEA) economic growth in 2025 is projected to surpass the global average - 4.1% v. 3%. This growth is fuelled by a rapidly growing middle class, infrastructure investment, and digitalization. More than 460 million people are now online, and the region’s digital economy is expected to exceed US$330 billion by 2025 and potentially US$1 trillion by 2030, according to the 2024 e-Conomy SEA report by Google, Temasek, and Bain & Company.

SEA is charting a path for regional transformation, led by a new, diverse generation of builders and investors. This wave includes female entrepreneurs innovating across technology-enabled sectors, gender-diverse fund managers and investors cultivating inclusive and locally grounded investment theses. Together, this ecosystem can contribute to SEA’s economic rise and reshape the foundations of how value is created, distributed, and scaled across the region.

Southeast Asia is at an inflection point.

In SEA, there are several structural forces that support a regional inflection point for technology-led venture investment:

1. Demographic dividend and consumer demand

SEA boasts a relatively young, digitally savvy population, with over 60% of the region’s inhabitants ~380 million people - under 35, and the time spent on social media ranking among the world’s highest. As these young people continue to join the workforce, there is an opportunity for increased productivity and accelerated growth. In addition, rising GDP per capita and urbanisation has created a large middle‑class consumer base. Women play a pivotal role, as individuals, as the primary decision‑makers for household spending, and as business founders and leaders. Women are shaping market trends and driving economic sectors such as e-commerce, health and wellness, and B2B services.

2. Digital adoption tracking other large markets

Since 2016 the number of people online has doubled across “SEA-6” countries: Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam. Like China in the early 2010s, SEA is leapfrogging physical infrastructure constraints through mobile‑first platforms with e‑commerce gross merchandise value (“GMV”) and revenues growing at double‑digit rates, according to the 2024 e-Conomy SEA report. These growth metrics mirror China’s and India’s early digital surges.

Crucially, this momentum is also unfolding with increasing digital gender parity. Today, 70% of men and 65% of women in the region use the internet (up from just 37% and 27% respectively in 2015). This progress has brought the SEA-6 countries to an average of 0.96 for internet parity and 0.98 for mobile parity, outpacing global benchmarks of 0.89 and 0.93 respectively.

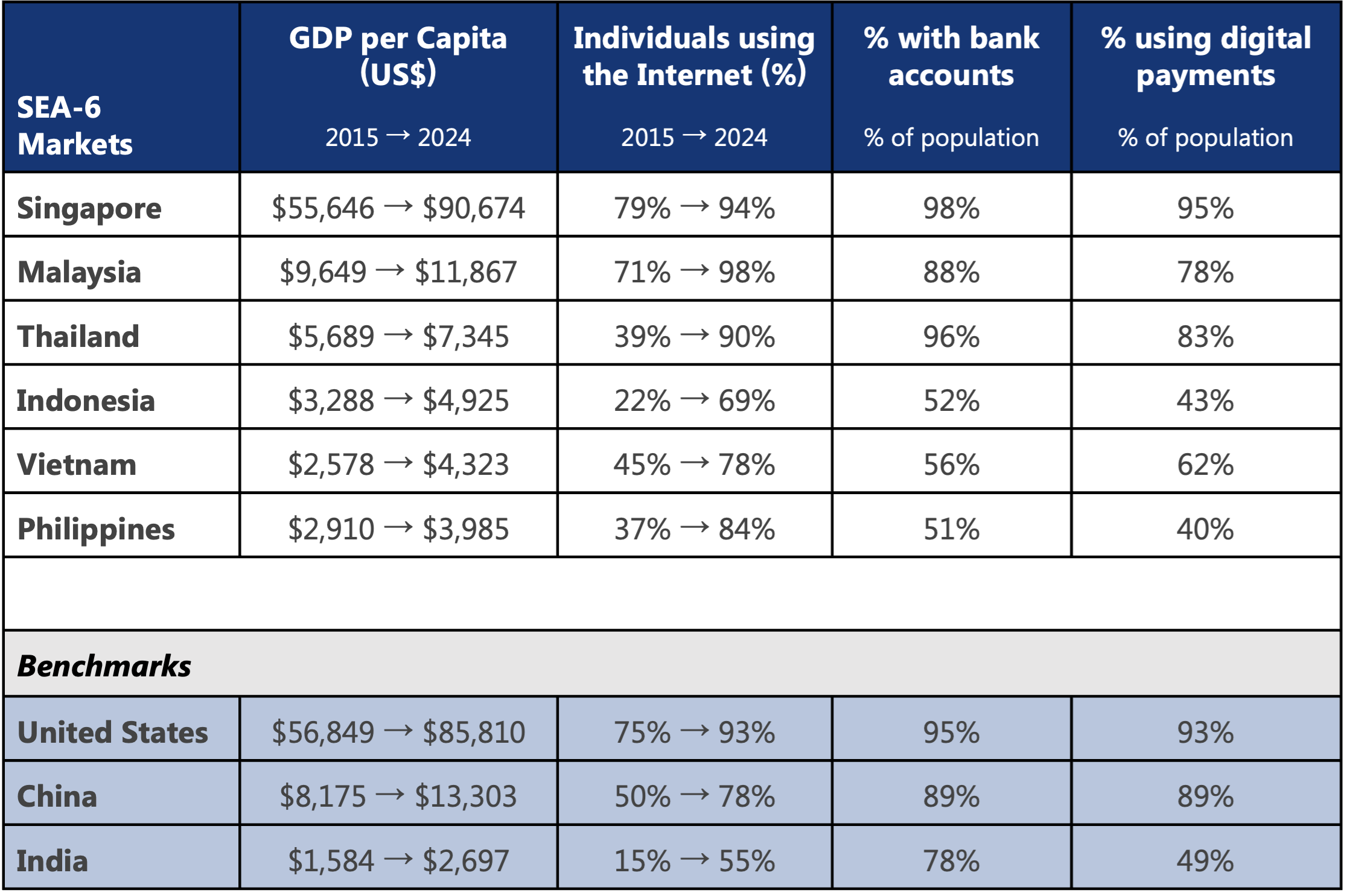

A closer look at the SEA-6 digital markets

The SEA-6 countries are now collectively approaching the digital thresholds that previously marked inflection points in markets like the U.S., China, and India where mass internet adoption and growing financial inclusion have triggered surges in tech entrepreneurship and investment activity.

Source: World Bank

3. Investment in digital infrastructure

Despite the tighter global liquidity environment, tech investment increased 68% YoY in 2024 in SEA. Over the past four years, total investment in the sector has reached US$9.9b, a nearly 3x increase compared to 2017-2020. Leading investors include KKR, DigitalBridge and Stonepeak. Digital infrastructure took center stage in tech investment in H2 2024, with a record US$4.4B deployed in SEA, spanning data centers, telecom towers and fiber assets. SEA is becoming a leading destination for GPs and corporate giants like Google, AWS and Oracle, making strategic investments to enhance digital capabilities and foster local talent development across the region.

4. A burgeoning number of talented, high performing fund managers

Over the last decade, Asia's Venture Capital asset base has expanded over 21-fold, and SEA alone has minted over 50+ unicorns. This has been fueled by, and resulted in, more VC fund managers.

The presence of women among VC is an important ingredient for success because a lack of diversity in investment discussions limits the range of perspectives considered, ultimately constraining capital allocation to a narrower set of opportunities, according to new research by the International Finance Corporation (IFC). In addition, gender-balanced funds exhibit three times lower write-off rates than male-dominated funds (1.6 percent vs. 4.7 percent). SEA is host to a growing number of women investors: the GPCA included 263 women investors working in VC in its Director of Women Investors in SEA released earlier this year.

5. Innovative business models that capture the potential of the regional market.

As SEA’s tech industry matures, the next wave of winners will likely be companies that can:

Seize on the the large market and regional ambition of SEA, while successfully navigating differences in language, norms and user behavior;

Embed trust and transparency in consumer relationships;

Build sticky ecosystems around essential services; and

Deliver clear revenue pathways and capital efficiency.

One such example is data center pioneer DayOne led by CEO Ms. Jamie Khoo, which has been able to successfully raise $1.9B in 2024, and rapidly expand using a hub and spoke model that combines Malaysia, Indonesia and Singapore into an integrated ecosystem. Another is Homage, founded by Ms. Gillian Tee, that provides on-demand elder care services. The company has expanded from its homebase in Singapore into Malaysia and Australia by adapting its offering for the specific needs of local consumers. Finally, TransTRACK, founded by Ms. Anggia Meisesari, offers end-to-end solutions for the logistics and transportation industry, specific to the region. The Indonesia-based company has expanded to Singapore and Malaysia, and has raised the needed funds to further expand into Thailand, Vietnam and Australia.

6. Exits gaining traction:

We are starting to see a shift in the exit landscape in SEA. In 2024, the value of exits in the region was $US6.3B, 138% YoY growth. Notable exits include Singapore-based PropertyGuru (key investors KKR, REA Group, TPG) with an exit value of $1.1B; and Malaysia-based GHL Systems (key investors Actis, Apis Partners), with an exit value of $154M. Countries in the region are taking steps to strengthen local exchanges to attract more listings. For example, Singapore’s central bank announced a $3.7 billion Equity Market Development Program and tax incentives to deepen its equity markets, while Malaysia reduced the stamp duty on equities traded on its exchange.

Today, SEA is at a tipping point, similar to those in the US in the late 1990s and early 2000s with the original consumer internet boom that saw the rise of Amazon, Google and Facebook; China in the mid-2000s with homegrown platforms like Alibaba and Tencent dominating a mobile-first population; and India's B2C wave in the 2010s, catalyzed by Jio's rollout and a surge in digital adoption. This acceleration phase is underpinned by an increasing maturity of digital infrastructure, supportive policy environments and a more sophisticated pool of investors backing cutting-edge and business model innovation. SEA has the opportunity to define its own venture trajectory where inclusion, localization and innovation intersect.