Why DPI is the new IRR

November 2025

In a world where Internal Rate of Return (“IRR”) once reigned as the gold standard, LP sentiment has shifted toward Distributions to Paid-In Capital (“DPI”) as the leading indicator of success. This is hardly surprising - the tightening liquidity environment, higher interest rates, and subdued exit markets have forced investors to focus on realized returns over paper markups. Across Southeast Asia, this paradigm shift is reshaping how GPs approach liquidity and what LPs expect in return.

Why DPI Matters Now More than Ever

Private market investing has long been a game of patience. But today, the cost of waiting has risen dramatically. Since 2022, global interest rates have surged in response to inflationary pressures, raising the opportunity cost of illiquid private fund commitments. This has compressed returns and made traditional exit pathways like IPOs and M&A become less dependable. According to Bain & Company’s 2024 Global M&A Report, global deal activity continues to lag pre-pandemic levels, which left many fund vintages sitting on unrealized gains and fewer options for distributions.

As capital becomes more expensive, GPs are under growing pressure to prove not just potential returns, but actual cash distributions. LPs, particularly those with shorter capital cycles or liability-linked mandates like insurance companies and family offices, are prioritizing DPI and cash flow predictability.

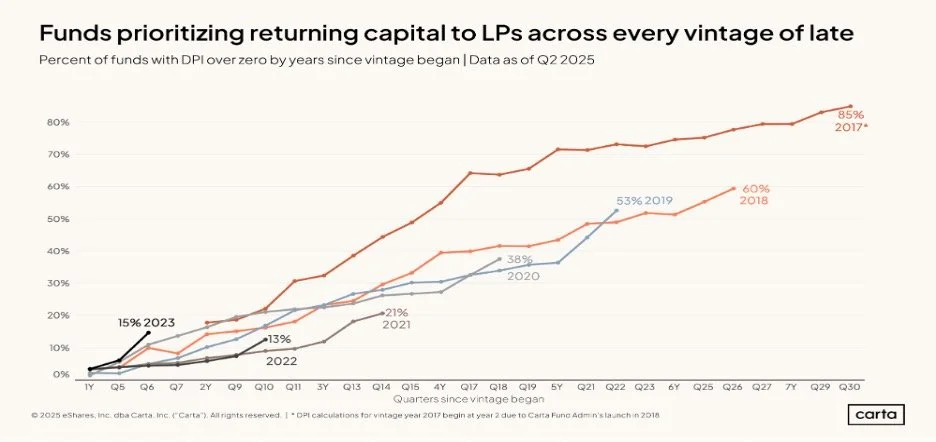

Recent data from Carta’s VC Fund Performance Q2 2025 Report reflects this shift in LP expectations. For example, 15% of 2023 vintage funds had already begun distributing by just six quarters in, outpacing funds of earlier vintages (2018-2022). This phenomenon highlights a growing urgency whereby in today’s post-COVID valuation environment, LPs are looking for liquidity faster and GPs must increasingly consider alternative strategies to deliver DPI and attract new capital.

DPI in Southeast Asia

This pivot toward DPI is particularly salient in Southeast Asia, where exit pathways are still maturing relative to markets like the U.S. or China. While regional IPOs like Grab and Gojek drew global headlines in 2021-22, the broader exit market momentum has been more gradual, with many SEA startups choosing to wait for improved valuations amid subdued public markets and macroeconomic headwinds, a trend recently underscored by Nikkei Asia.

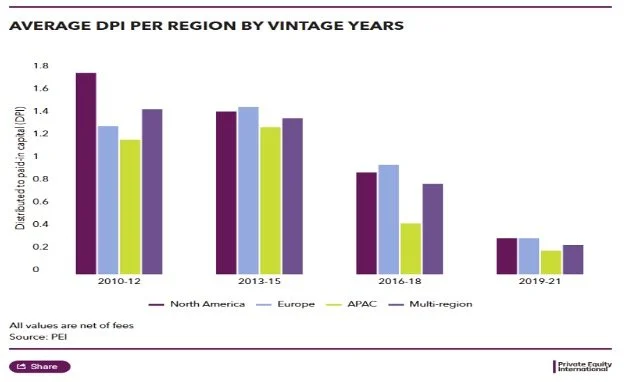

That said, there are encouraging signs of momentum. According to Private Equity International, while earlier APAC vintage funds (2016-2018) posted a median DPI just under 0.45x, the more recent vintages (2019-2021) are beginning to show stronger early distribution activity with a median DPI of 0.21x. This uptick mirrors broader global trends, where GPs are increasingly prioritizing liquidity on the backdrop of a maturing ecosystem.

Diverse fund managers* are also a bright spot. A 2025 National Association of Investment Companies (“NAIC”) report found that these managers outperformed industry medians with a 0.65x DPI, compared to Burgiss’ 0.44x benchmark across all private equity managers. As such, these dynamics invite a more nuanced consideration of who delivers DPI and how. In Southeast Asia, where women-led and gender-balanced funds remain undercapitalized, this could spell opportunities in plain sight. A recent Forbes survey reinforced this, citing the continued underfunding of diverse managers despite their strong performance. As Ballentine Partners’ Julie Pulda noted in the article: “While genius is distributed equally, opportunity is not… investing in diverse talent is not only a matter of equity but also smart investing.”

*Diverse-owned managers are investment firms with ownership or significant leadership from women or members of ethnic minorities.

Fund Mechanics Matter too - Hybrids, Evergreen, Secondaries and Continuations

To address the DPI imperative, fund managers across the region are embracing more flexible structures that allow them to deliver returns earlier and more predictably. Four emerging models stand out:

1. Hybrid Funds

Hybrid funds blend equity and debt investment components to generate contractual cash flows that enable GPs to begin distributions earlier in the fund lifecycle, thereby reducing reliance on long holding periods or traditional exits for LPs. Circulate Capital, a gender-balanced fund manager, exemplifies this approach by providing both equity and debt to innovative companies and technologies that transform and disrupt in Southeast Asia, and with the potential for technology transfer to other high growth markets.

2. Evergreen Funds

Unlike traditional closed-ended vehicles, evergreen structures allow LPs to enter and exit at periodic intervals, offering greater capital flexibility and ongoing liquidity. In October 2025, Hamilton Lane, a gender-balanced global investment firm, launched the Hamilton Lane Global Venture and Growth Fund, an evergreen vehicle designed to democratize access to venture capital for private wealth investors. This structure allows investors to enjoy periodic redemptions, providing earlier and more flexible liquidity while maintaining exposure to global growth opportunities, including in Asia.

3. Secondaries / Continuation Funds

Continuation Funds or Secondaries (e.g., GP-led transactions) are no longer viewed as last resorts, but rather as strategic tools to unlock liquidity. In 2025, East Ventures, a gender-balanced Southeast Asia firm, closed its inaugural GP-led secondary vehicle with Coller Capital. The transaction enabled the firm to return capital to early-investing LPs while retaining upside exposure to select promising companies, which demonstrated how secondaries can boost DPI without diminishing long-term value creation.

These mechanics are improving the distribution profile of funds and offering LPs greater visibility, flexibility, and cash flow predictability across the fund lifecycle.

Conclusion

The interplay between DPI and long-term value creation is critical to the growth of Southeast Asia’s private capital ecosystem. Women-led and gender-balanced fund managers are on the leading edge of this evolving landscape, contributing differentiated perspectives and strategies. A balanced focus on near-term liquidity and enduring enterprise value that meets the needs of companies and investors will be the cornerstone of successful funds in the region and of resilient private markets going forward.